Understanding Medicare Options in Virginia

Understanding Medicare Options in Virginia

Medicare is a vital program that provides health insurance coverage to millions of Americans, including those residing in Virginia. It is crucial for residents of Virginia to have a comprehensive understanding of the available Medicare options to make informed decisions regarding their healthcare needs. In this article, we will delve into the various Medicare options in Virginia, exploring the coverage, eligibility criteria, and enrollment process. Whether you’re a current Medicare beneficiary or approaching Medicare eligibility, this guide will help you navigate the complexities of Medicare in Virginia.

Table of Contents

- Introduction to Medicare

- Original Medicare (Parts A and B)

- Medicare Advantage (Part C)

- Prescription Drug Coverage (Part D)

- Medicare Supplement Insurance (Medigap)

- Special Needs Plans (SNPs)

- Medicare Enrollment Periods

- Extra Help with Prescription Drug Costs

- Medicare Savings Programs

- Frequently Asked Questions (FAQs)

1. Introduction to Medicare

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, although it also covers certain individuals with disabilities or end-stage renal disease. It consists of different parts that provide different types of coverage.

2. Original Medicare (Parts A and B)

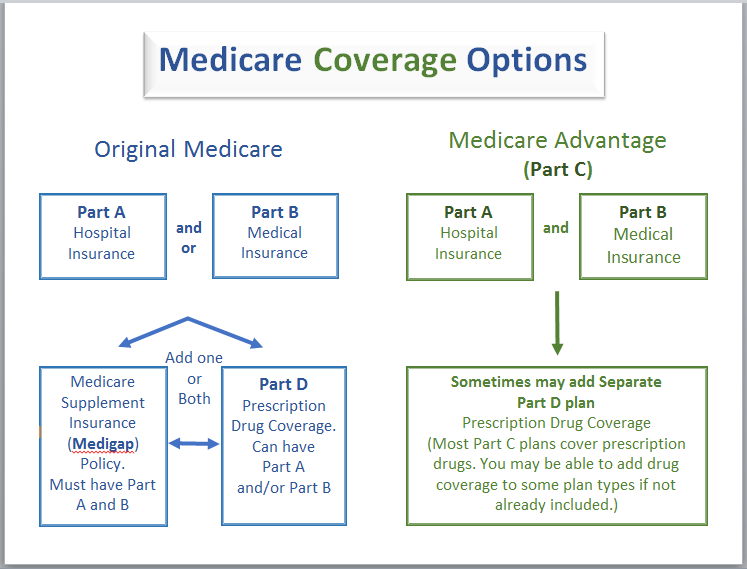

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). Part A helps cover inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare services. Part B covers doctor visits, preventive services, outpatient care, and medically necessary supplies.

3. Medicare Advantage (Part C)

Medicare Advantage, also known as Part C, is an alternative to Original Medicare. Offered by private insurance companies approved by Medicare, Part C plans provide all the benefits of Original Medicare (Parts A and B) and often include additional benefits such as prescription drug coverage, vision, dental, and hearing services.

4. Prescription Drug Coverage (Part D)

Medicare Part D offers prescription drug coverage. This coverage is provided through private insurance companies contracted with Medicare. It helps pay for both brand-name and generic prescription medications, ensuring that beneficiaries have access to the medications they need.

5. Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, also known as Medigap, is offered by private insurance companies to help fill the gaps in Original Medicare coverage. Medigap plans cover certain out-of-pocket costs, such as deductibles, coinsurance, and copayments, providing beneficiaries with greater financial protection.

6. Special Needs Plans (SNPs)

Special Needs Plans are specialized Medicare Advantage plans designed for individuals with specific health conditions or living situations. SNPs provide tailored coverage to address the unique needs of beneficiaries with chronic illnesses, institutional conditions, or those who qualify for both Medicare and Medicaid.

7. Medicare Enrollment Periods

Understanding Medicare enrollment periods is essential to ensure timely coverage. The Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare, lasting seven months. The General Enrollment Period (GEP) allows individuals to enroll or make changes to their coverage each year from January 1st to March 31st. Special Enrollment Periods (SEPs) are available in certain circumstances, such as moving or losing employer coverage.

8. Extra Help with Prescription Drug Costs

The Extra Help program provides financial assistance to Medicare beneficiaries with limited income and resources to help cover the costs of prescription drugs. Qualifying individuals receive help with premiums, deductibles, and copayments, ensuring affordable access to necessary medications.

9. Medicare Savings Programs

Medicare Savings Programs are state-based programs that help low-income individuals and families pay for Medicare premiums, deductibles, coinsurance, and copayments. These programs vary by state, so it’s essential to understand the options available in Virginia.

10. Frequently Asked Questions (FAQs)

Q1: Who is eligible for Medicare in Virginia?

A1: Individuals aged 65 and older, certain individuals with disabilities, and those with end-stage renal disease may be eligible for Medicare in Virginia.

Q2: Can I have both Medicare and Medicaid in Virginia?

A2: Yes, it is possible to have both Medicare and Medicaid in Virginia. Individuals who meet the eligibility criteria for both programs can benefit from the coordinated coverage they provide.

Q3: How can I compare Medicare Advantage plans in Virginia?

A3: You can compare Medicare Advantage plans in Virginia using the Medicare Plan Finder tool provided by the Centers for Medicare & Medicaid Services (CMS) website.

Q4: What is the best time to enroll in Medicare in Virginia?

A4: The best time to enroll in Medicare in Virginia is during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday month and ends three months after.

Q5: Are prescription drug costs covered by Medicare in Virginia?

A5: Prescription drug costs are covered by Medicare in Virginia through Medicare Part D plans. It’s essential to choose a plan that meets your medication needs.

Conclusion

Navigating the various Medicare options available in Virginia can be complex, but with the right knowledge, you can make informed decisions about your healthcare coverage. Understanding the differences between Original Medicare, Medicare Advantage, prescription drug coverage, Medigap, and Special Needs Plans will help you select the best options for your specific needs. Remember to consider enrollment periods, financial assistance programs, and eligibility criteria to maximize the benefits available to you.